Research reveals how data is fueling innovation in insurance

Research reveals how the insurance industry uses data collection and management to drive innovation with emerging technologies. Among the perceived benefits are better customer experiences, improved access for the underinsured, more precise risk assessment, and new efficiency gains via automated processes.

The idea of your teenager driving can evoke a wide range of emotions. As easy as it is to share the excitement over their new-found freedom, it’s just as easy to get lost in an endless string of “what-ifs.” What if their car breaks down? What if they’re in an accident?

Fortunately, the adoption of data-driven emerging technology in the insurance industry offers some relief from anxiety: Real-time diagnostics are available to help prevent break-downs and avoid accidents with driver alerts, lane corrections, auto-braking, and more. If an accident does occur, assistance is available immediately, whether it’s as high priority as crash response to verify driver and passenger safety or lower priority, such as automating the insurance claim.

In my role at Iron Mountain, it’s a priority to understand which technologies are transforming insurance and how they’re doing so. Recently, Iron Mountain sponsored digital listening research to gain more insight into trending topics in the insurance industry. Here’s what we learned.

Data is the source of innovation

- Transitioning from legacy infrastructure to cloud-based technology provides more flexibility and innovation.

- Data collected from connected Internet of Things (IoT) devices enables insurance companies to assess risk at the time of policy purchase.

- Customer relationship management (CRM) software improves customer service and claims processing while aggregating data to streamline the customer journey.

- Artificial intelligence (AI)-powered automation systems handle claims processing tasks, though technology critics are wary of the ways those systems can introduce bias or be manipulated.

- Embedded insurance increases customer touchpoints by offering policy coverage at the point of sale. Insurance companies expect data-enabling technology to drive growth and competition amongst InsurTech startups in the industry. Anticipated outcomes from these innovations include optimised customer experience, improved access for the underinsured, more precise risk assessments, and new efficiency gains via automated processes.

Let’s look at the leading technologies—such as AI, blockchain, and metaverse—included in our trend research, from which two stood out: AI and blockchain.

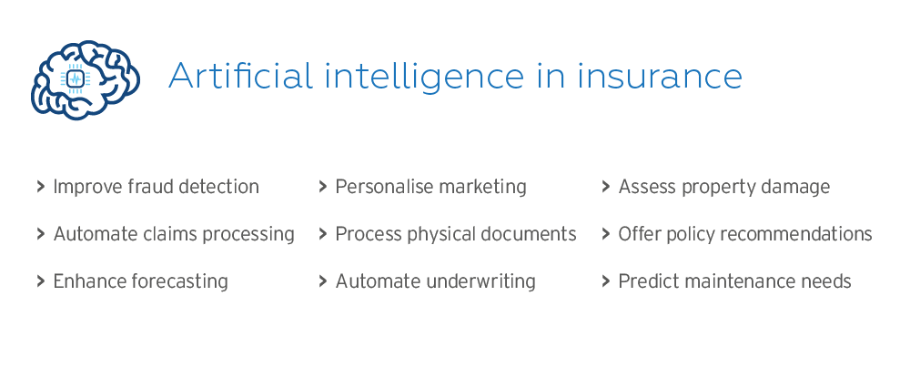

Artificial intelligence

Our research revealed that insurance and innovation conversations about AI are in high volume due to the wide range of applications. Simultaneously, these conversations also discuss the potential risks of AI to ensure proper deployment.

Conversations about insurance and AI focus on four areas that better predict risk. Insurance risk professionals use AI to forecast events, such as evaluating the financial impact of pandemics and climate change. AI also helps to manage risk, identifying fraudulent claims and financial vulnerabilities faster via the validation of information. In underwriting, AI automates manual processes by gathering massive data from various sources such as external applications, insurers, and customers. Insurers also use AI to help customers predict housing prices in the face of increasingly frequent natural disasters such as floods or wildfires.

AI risks in insurance are based on social responsibility, bringing attention to biases and other potential harms, including improper use of historical data in predictive modeling. In addition, emerging regulations around insurance and AI are getting stricter to increase privacy and security, prevent bias, and enforce transparency.

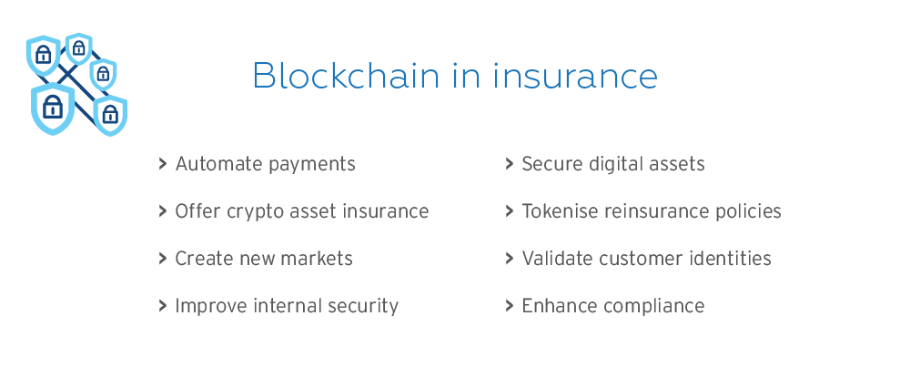

Blockchain

Our research found that blockchain conversations in insurance are also in high volume.

Conversations about insurance and blockchain tend to focus on automation, where insurers see exciting potential in using blockchain and non-fungible token (NFT) technology to automate processes that have traditionally been time-intensive, such as claims processing. Insurance companies are also experimenting with blockchain and NFT technology to increase efficiency through tokenising contracts, trading insurance policies, and providing reinsurance. The emerging opportunity to insure digital assets is based on the prevalence of fraud and hacks in NFT marketplaces.

Insurance conversations also revolve around smart contracts. Capabilities include instant payments, such as passenger reimbursement after flight delays, policy sales and verification, and crop insurance for farmers who are affected by changes in climate.

Safeguarding the future of insurance

Data collection and management help to propel the insurance industry into a more digital future in which blockchain and AI have significant roles. As an Iron Mountain employee, I hear from customers about how they benefit from data management and data security across physical and digital records and processes through information lifecycle services and solutions. As a parent, helping insurance companies unlock value from data to better support current and future customers–including my children–is invaluable.

Learn more about how Iron Mountain helps transform the insurance industry.

About the research: Quadrant Strategies used digital research tools to study public online conversations about key innovative technologies in specific industries from January 2022 to December 2022. Top technologies flagged on Twitter cover the period January 2021–December 2022. Iron Mountain sponsored this research.

Featured services & solutions

Related resources

View More Resources