Banking trends a perspective from Iron Mountain

Current economic headwinds create new pressures on banks, so stability and resilience are essential

Exclusive Preview

TRENDS THAT DRIVE INNOVATION

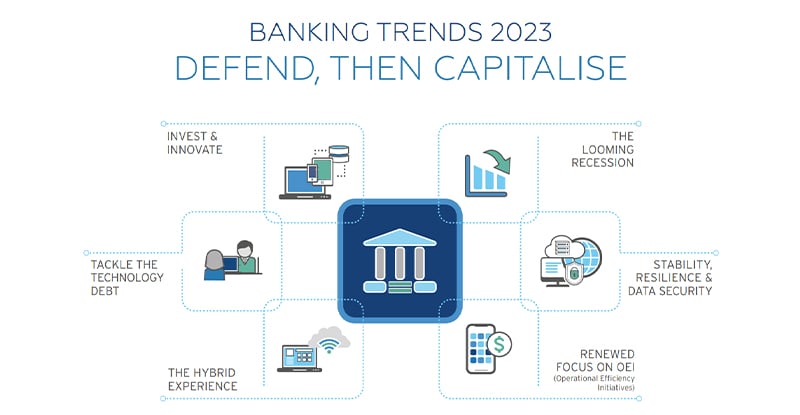

WHAT TRENDS WILL BANKS CONSIDER AS THEY DRIVE CHANGE?

Current economic headwinds create new pressures on banks, so stability and resilience are essential. However, innovation and digital transformation must be priorities for banks to deliver customer value and remain competitive. We’ve reviewed predictions and perspectives from the experts to share key themes around banking industry challenges for 2023.

Economic uncertainty creates a need to balance stability with innovation.

Interest rates and inflation are high, and consumer demand is slowing. Economists say there’s a 7 in 10 chance the U.S. will see a recession in 2023. Yet, while battening down the hatches and waiting for the storm to pass, forward-thinking banks need to invest in innovation to be prepared for when the economy turns around. Banks should explore new sources of value beyond the current thinking.

Efficiency in banking processes is a way to cautiously gain ground.

It’s important for banks to prioritise operational efficiency and cost control. “Process miners” will be seen as heroes for banks as they focus on operational efficiency and effectiveness initiatives.

“Cost-cutting has become a priority for 73% of financial services firms.”

Banks are challenged to provide a more compelling digital customer experience.

During the pandemic, customer experience (CX) was transformed to involve more digital and hybrid interactions. Customers now demand digital services and have high expectations.

Banking organisations compete by delivering new sources of value, often based on technological advancements.

Adopting advanced technologies can be a way to gain greater operational efficiencies and maintain a competitive advantage. Digital inertia and a lack of technology investment will come at a cost to banking organisations.

Digital transformation is forging ahead in the banking sector; don’t get left behind.

Everyone is looking ahead to the digital end game, and banks are realising that digital transformation has the ability to unlock cost savings and business value. Banks have plenty of data, but they often lack the means to derive value from it. Accelerated digital transformation gives banks the tools to transform the foundations of banking.

Resource constraints lead to prioritising conservative objectives.

Banks are facing resource constraints including loss of productivity due to attrition among existing talent and challenges in recruiting new talent. They are now prioritising more conservative objectives — customer experience (CX), operations excellence and new products/services — above revenue growth. Initiatives around operational efficiency and effectiveness are a priority.

Featured services & solutions

TRENDS THAT DRIVE INNOVATION

WHAT TRENDS WILL BANKS CONSIDER AS THEY DRIVE CHANGE?

Current economic headwinds create new pressures on banks, so stability and resilience are essential. However, innovation and digital transformation must be priorities for banks to deliver customer value and remain competitive. We’ve reviewed predictions and perspectives from the experts to share key themes around banking industry challenges for 2023.

Economic uncertainty creates a need to balance stability with innovation.

Interest rates and inflation are high, and consumer demand is slowing. Economists say there’s a 7 in 10 chance the U.S. will see a recession in 2023. Yet, while battening down the hatches and waiting for the storm to pass, forward-thinking banks need to invest in innovation to be prepared for when the economy turns around. Banks should explore new sources of value beyond the current thinking.

Efficiency in banking processes is a way to cautiously gain ground.

It’s important for banks to prioritise operational efficiency and cost control. “Process miners” will be seen as heroes for banks as they focus on operational efficiency and effectiveness initiatives.

“Cost-cutting has become a priority for 73% of financial services firms.”

Banks are challenged to provide a more compelling digital customer experience.

During the pandemic, customer experience (CX) was transformed to involve more digital and hybrid interactions. Customers now demand digital services and have high expectations.

Banking organisations compete by delivering new sources of value, often based on technological advancements.

Adopting advanced technologies can be a way to gain greater operational efficiencies and maintain a competitive advantage. Digital inertia and a lack of technology investment will come at a cost to banking organisations.

Digital transformation is forging ahead in the banking sector; don’t get left behind.

Everyone is looking ahead to the digital end game, and banks are realising that digital transformation has the ability to unlock cost savings and business value. Banks have plenty of data, but they often lack the means to derive value from it. Accelerated digital transformation gives banks the tools to transform the foundations of banking.

Resource constraints lead to prioritising conservative objectives.

Banks are facing resource constraints including loss of productivity due to attrition among existing talent and challenges in recruiting new talent. They are now prioritising more conservative objectives — customer experience (CX), operations excellence and new products/services — above revenue growth. Initiatives around operational efficiency and effectiveness are a priority.

“Prepare to help banks to implement their digital enterprise vision.”

IRON MOUNTAIN’S POINT OF VIEW ON 2023 BANKING TRENDS

THE IMPACT OF THESE PREDICTIONS AND HOW THEY DRIVE DECISIONS.

We believe the trends discussed above will drive banking organisations’ decision-making in 2023 — either operationally, investment-wise or architecturally.

One overarching, holistic theme for banks this year is the drive to net zero. This is not only in terms of sustainability and carbon footprint, but also in terms of reducing an organisation’s footprint in the areas of real estate, physical assets, processes and technology debt. Bank branches are closing, and physical assets, including IT assets, will be reduced. Processes are being streamlined and modernised, including adopting an agile approach. Banks must eliminate outdated technologies and modernise legacy architecture. Finally, environmental, social and governance (ESG) has become a business imperative, and banks are under pressure to meet their goals. These include reducing environmental greenhouse gasses, achieving net zero carbon usage, and demonstrating tangible results.

IN 2023, BANKS SHOULD:

- Face the Looming Recession Head-On. The year 2023 is expected to be economically tumultuous. A global recession is looming; it will drive loan loss provisions higher and also weigh on earnings, asset quality, funding and liquidity. All businesses must prepare for difficult times, yet there are also opportunities in a recessionary environment. This is the time to reassess traditional product, service and industry boundaries to create new sources of value.

- Ensure Stability, Resilience and Trust, backed by Data Security. Stability, resilience and working with trusted organisations will be guiding principles in 2023. This is supported by data security which is foundational to all decisions. Operating models may be improved with better processes, skills and cybersecurity. We anticipate some banks will move their tech budgets away from transforming core systems toward digital engagement solutions — but this won’t solve the problem. A modern core lets banks provide real-time information to deliver better products and services.

- Renew Focus on Operational Efficiency Initiatives (OEI). Operational efficiency and cost control will be prioritised in 2023, aligning innovation with the initiatives of automation and efficiency. Advanced technologies, such as AI, have the potential to help banks achieve radical cost reductions, which will be a major focus in such a volatile revenue environment.

- Embrace the Hybrid Experience. Banking customers often prefer hybrid experiences over purely digital or physical experiences. It’s important to prioritise CX strategies that are data-driven, consistent across channels, and offer consumers personalised advice to navigate difficult economic conditions. This requires coordination between the front and back offices, as well as the way branch infrastructure works.

- Tackle the Technology Debt. Many banks are dealing with technology debt as they enter 2023. They are struggling both with technologies that are no longer useful and with legacy architecture that needs to be modernised. Although it’s tempting to avoid technology investment in a downturn, banks that don’t handle their technology debt will lose out to the competition.

- Invest and Innovate. Given 2023 economic conditions, investment and innovation will be approached cautiously. But those who do not innovate will find themselves further behind. A continued move toward end-to-end digitisation will enable complex workflows to be streamlined and automated. Innovation around AI and IoT will help with enhanced decision making and robotic process automation (RPA).

IMPACT ON RETAIL BANKING, COMMERCIAL BANKING AND WEALTH MANAGEMENT

DIFFERENT SUBSECTORS OF THE BANKING INDUSTRY WILL EXPERIENCE DIFFERENT CHALLENGES.

At Iron Mountain, we work with customers who span retail, commercial and wealth management banking. In fact, 2,500 financial services institutions worldwide work with Iron Mountain. Here’s a closer look at how different subsectors within the banking industry will face the challenges of 2023.

In general, banks are facing 2023 in a position of relative strength. Capital buffers are strong, and liquidity is adequate. As a result, due to higher net interest income from rising rates, retail banking should fare well in 2023. However, investment banking performance will probably be mixed due to languishing underwriting and M&A advisory activities.

Retail banks

Commercial banks

Wealth management

STABILITY, RESILIENCE, AND INNOVATION

AS BANKING INSTITUTIONS MOVE FORWARD WITH THEIR DIGITAL TRANSFORMATION INITIATIVES, IRON MOUNTAIN KNOWS THE ROPES.

We believe banks will renew their focus on operational efficiency and effectiveness initiatives to maintain stability and resilience in 2023. At the same time, they’ll sustain a focus on innovation — including digital transformation — so they don’t fall behind.

Ultimately, by 2027, 93% of managers, directors and executives have a goal to eliminate paper records, according to a research survey commissioned by Iron Mountain. Clean-up of paper records cuts costs and risk, while opening the door to reveal new value from digital information. Digital transformation will be essential as the banking industry evolves and services customers.

Iron Mountain can help banking institutions achieve the following outcomes to fulfill their goals.

Explore all Iron Mountain Banking Solutions.

Related resources

View More Resources

Make your HR systems work better for you

Want to continue exploring?

Enter your information to access the full content.