Paper may be putting your bank at risk—go paperless!

Achieving operational efficiencies while delivering an outstanding customer experience continue to be key business goals impacting the bank branches.

Digitise | Store | Automate | Unlock

Challenge: Paper may be putting you at risk

Paper records created and stored in the bank branch can pose significant business risk to the bank resulting in:

- Limited visibility and governance over sensitive customer information

- Inefficient and costly manual processes

- Difficulty accessing information quickly impacting the customers’ experience, especially in the case of natural disasters or unforeseen closures

Becoming a paperless branch—the digital way

Reduce Your Risk

Paper customer records created and stored in the bank branch can pose significant business risk resulting in:

- Limited visibility and governance over sensitive customer information;

- Costly and inefficient manual processes;

- Difficulty accessing information quickly impacting the customers’ experience - especially in the case of natural disasters, unforeseen closures, or merger and acquisition activity.

Provide controlled digital access and transparency into your heavily-regulated customer files. Your customer’s sensitive data is securely protected ensuring security, privacy and compliance with your policies.

A tier 1 North American bank tackled paper in over 1,000 of its branches.

We addressed an audit finding on the branch's governance of client documents. Based on client classification and record retention schedules, we determined and executed a store vs destroy strategy.

Improve Your Branch Efficiency

Optimize your costly branch footprint. We efficiently digitize physical customer and operational documents - eliminating the need for onsite filing cabinets. You can make better use of your branch space and have secure data access anywhere.

We worked with a global bank with over 1,400 branches in Latin America.

We provided rapid and accurate indexing of critical customer data that freed up branch space by eliminating stored branch boxes. They achieved a secure chain of custody with scanned and indexed digital files in an electronic repository. The right documents were then put in long term storage for compliance requirements.

Elevate Your Customer Experience

Impact the branch experience by providing your bank staff a fast 360-degree view of all customer data and operations files - the centralized information enhances visibility and access.

A tier 1 U.S. retail bank tackled paper at more than 5,000 branches.

We eliminated legacy files within the branches by digitizing and providing visibility into key files. As a result, their customers can receive better service. Based on classification and record retention schedules provided, we stored information they needed and securely destroyed the rest.

Becoming a paperless bank - the digital way

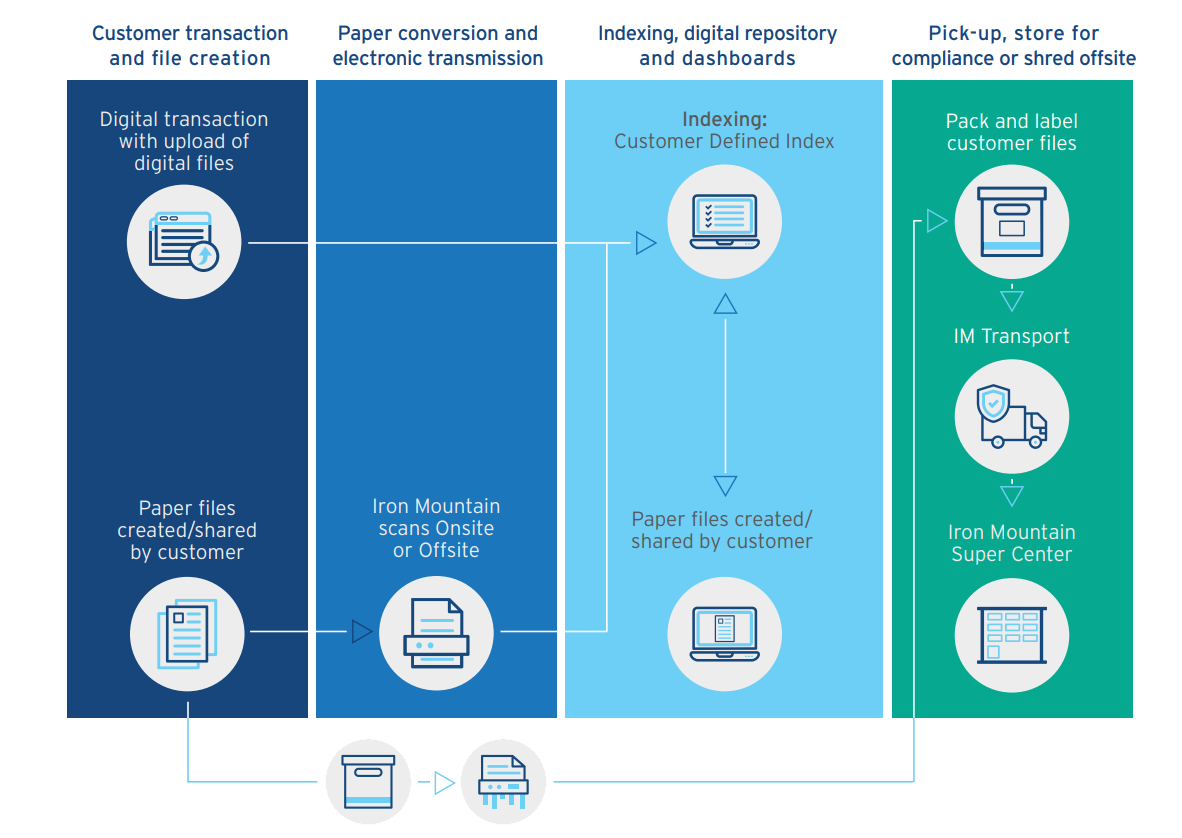

We support legacy and net-new file processes to accelerate your journey.

Complementary service options:

- Records Storage - We pick up, transport and securely store your customer records based on your compliance guidelines

- Information Governance - We assist with reviewing, improving, or accelerating the intricacies of information retention, privacy, compliance and risk management

- Smart Sort - We sort and reorganize your files according to destruction eligibility, record type, record status, unique identifier

- Clean Start - We manage the clean-out process and provide services to facilitate the secure destruction, or donation of the items you no longer need

Go paperless with Iron Mountain

- 94Scale: 94 centers across 44 countries specialising in imaging, indexing, QA, and processing - handling over 1.5 billion documents per year

- End to EndEnd-to-end information management including picking up physical documents, digitising and storing assets in a cloud repository, and paper disposition

- 1000Deep experience from custom engagements with Fortune 1000 customers building and refining options for banking

Learn more about Iron Mountain and contact us if you would like to know what are your next steps in the journey of becoming a truly paperless bank.

Featured services & solutions

Document Scanning & Digital Storage Services

Digitally transform your business and centralise your information

InSight Intelligent Document Processing

Digitise, store, automate, and unlock the power of your data through the power of automation

Iron Mountain InSight®

When you have a mix of physical and digital documents across many repositories, your employees can struggle to quickly find what they need, have difficulty sharing information and it can increase your organization’s risk of non-compliance.

Digital transformation: Are we there yet?

Accelerate your digital transformation journey in five steps.

Related resources

View More Resources