Elevate the power of your work

Get a FREE consultation today!

A flexible hybrid approach to digital infrastructure will help financial services firms of all sizes to survive and thrive

A flexible hybrid approach to digital infrastructure will help financial services firms of all sizes to survive and thrive

The digital transformation of the $20 trillion financial services sector is more radical - and more extensive - than any other. Bricks, mortar, back-offices, coins and paper have all transformed into digital assets and transactions. These transactions take place at far higher speeds than previously, and they also generate huge quantities of customer data that needs to be acted on. Partnerships between traditional service providers, neobanks and fintech firms are also creating new business models and revenue. And all of these touch points - transactions, transformations and partnerships - are now taking place in the data center.

Agility is the key to success in the current climate, and this applies as much to digital infrastructure as to leadership. The businesses with the most flexible infrastructure are best able to react quickly to changes in the market, using existing technology to solve problems and offer new value to customers. Open, clearly-defined and scalable architecture allows data to move freely and quickly between systems, services and partners. Whether you are an established financial institution aiming to transform and partner, or a cloud-native fintech, you will need a data center architecture that guards your core but connects you quickly and easily to anything, anywhere.

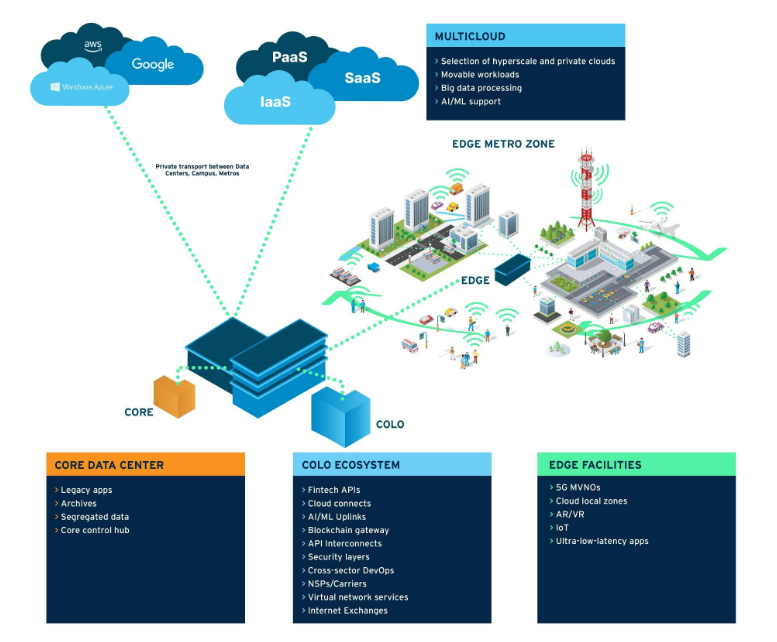

A hybrid colocation model split between core infrastructure, rich shared partner ecosystems and multiple clouds and networks will deliver this agility. These are the three core pieces of an agile architecture that allows legacy systems to be interconnected at low latency and migrated over time to containers in the cloud. It is also important to keep an eye on edge potential, as 5G MVNOs create the speed and bandwidth to make the gamification of next-gen services an exciting prospect for customers.

Colocation also allows financial firms to clear their decks for action. The right global colocation partner can take care of operational and embodied sustainability, security and third-party accreditations and standards, underpinning your own quality and ESG standards. Heavy lifting like migration, interconnection and IT asset lifecycle management can also be outsourced, freeing firms to concentrate on innovation and value creation.

This hybrid model of Core, Colo, Cloud and Edge gives firms the ability to partner up via API in the data center MMR, move workloads quickly in and out of the clouds and reach new customers with new edge services.

Source: Iron Mountain Data Centers:

Money on the Move: An overview of the current challenges, drivers and opportunities for financial services firmsGet a FREE consultation today!