Elevate the power of your work

Get a FREE consultation today!

This infrastructure planner will provide you a balanced overview of the Chicago data center market - its strengths and weaknesses, and the latest issues and opportunities.

This infrastructure planner will provide you a balanced overview of the Chicago data center market - its strengths and weaknesses, and the latest issues and opportunities.

Download this infrastructure planner report to learn more about:

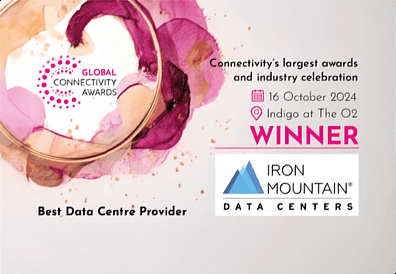

Iron Mountain is a global data center company that provides tailored, sustainable, secure, carrier and cloud-neutral colocation solutions.

Iron Mountain’s Chicago Data Center is ideal for both retail colocation & hyperscale data center needs, located in the Midwest suburb of Des Plaines.

Get a FREE consultation today!

North America continues to be the highest revenue contributor to the $55 BN+ global data center colocation market, accounting for around 35% of demand. According to GrandViewResearch, the North American market is forecast to exceed $43 BN by 2030, with a CAGR of 11.5%, but with the boom in cloud and AI-driven demand even these figures are beginning to look conservative The U.S. is the key force behind North American growth. The bulk of data center infrastructure is located in a small number of key strategically-located hotspots - Northern Virginia; Dallas/Fort Worth; Chicago; Silicon Valley; Phoenix; Atlanta; Hillsboro and New York Tri-State. The last year has seen record levels under construction, with primary market supply growing 26% year-over-year and over 3 GW under construction, a 46% year-over-year increase.

The generative AI boom, digital transformation, the growing adoption of multi-cloud, and network upgrades to support 5G are critical drivers of this growth. User requirements are growing in both size and number while power and supply chain constraints are creating challenges, and this, combined with rising power costs, means that prices are rising extremely fast. Average prices across key markets for a 250-500 kW requirement increased by a record 18.6% in 2023.

On the wholesale/hyperscale side, major deals of 60 MW and above are now common. As demand accelerates, space availability is becoming tighter and to avoid potential capacity bottlenecks down the line, pre-leasing 24-36 months ahead of use is now the norm, applying to over 80% of current builds in key markets. As a result, vacancy rates in the primary markets were extremely low (3.7%) in H2 2023.

Enter your information to access the full content.